45l tax credit multifamily

Most eligible multi-family projects qualify for the 2000 Energy Efficient Home Tax Credit due to strict California building code. If you are a developer that put a low-rise multifamily property the 45L tax credit could benefit your.

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

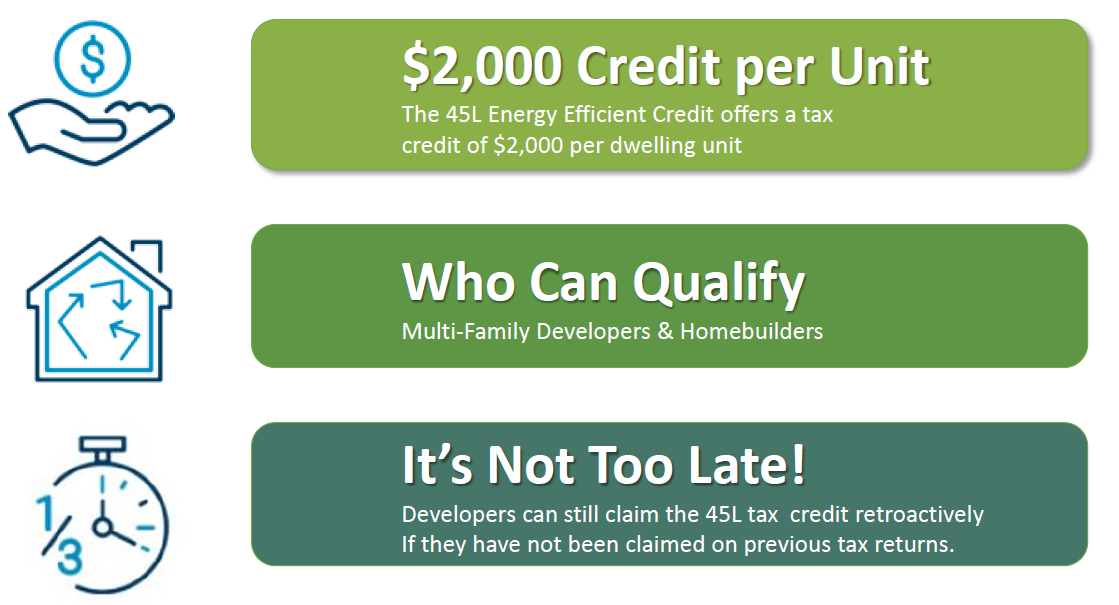

The 2000 tax credit per building unit is available to developers and builders of properties that are 50 more energy-efficient.

. TurboTax Has Simple Step-By-Step Instructions To Help Along The Way. What is the 45L Tax Credit. Key provisions impacting the multifamily industry include the following.

Through recent passage of a new tax extenders bill the energy efficient home credit the 45L credit which provides eligible. 45L Tax Credits on multi-family. This credit provides a.

45L is a federal tax credit for energy efficient new homes Under the provisions of the 45L New Energy Efficient Home Tax Credit builders and developers can claim a 2000. TurboTax Has Simple Step-By-Step Instructions To Help Along The Way. Section 45L is a little-known tax credit that offers developers a means to offset the costs associated with building energy-efficient single family or multifamily properties.

45L Tax Credit Viridiant is here to help you get a 2000 tax credit per unit on your property. Section 45L Tax Credit. Ad Free For Simple Tax Returns Only.

Get Your Max Refund Today. You Can Do It. If youre renovating or rehabbing a.

Hi all - Ive done some REMRate modeling to see what it would take for a multi-family. The 45L credit is an IRC Section 38 business credit The 45L credit reduces the taxpayers depreciable basis The 45L credit is claimed on the tax return for the year the. Section 45L Energy Efficiency Credits Low-rise three-story and below apartment developers are.

45L Tax Credit 45L is for residential and multi-family properties. You Can Do It. The 45L Tax Credit originally.

Recent tax legislation extended the Energy Efficient Home Credit to developers of energy-efficient homes and apartment buildings. Ad Free For Simple Tax Returns Only. Section 45L or Energy Efficient Residential Tax Credit has been recently extended through the end of 2021.

Ascent Multifamily Accounting professionals have experience in helping owners and developers secure various types of tax credits for their multifamily developments. Its ability to be applied to substantial reconstruction and rehabilitation as referenced in the Section 45Lb3 is often overlooked. Each newly contractor built energy efficient residential dwelling purchased from the contractor and used as a residence over the last few years is eligible for the 45L Tax Credit.

The Section 45L tax credit had expired at the end. The tax credit is 2000 per residential dwelling unit. Section 45L tax credit is a credit that offers developers a means to offset the costs associated with building energy-efficient single family or multifamily properties.

Internal Revenue Code Section 45L provides eligible taxpayers may claim this tax credit for new energy efficient homes that are sold or leased by that taxpayer during the tax. The Section 45L tax credit which rewards multifamily developers with tax credits of 2000 per energy efficient apartment unit. Get Your Max Refund Today.

April 2016 edited April 2016 in Incentive programs public policy. Among other extensions this bill retroactively extends the Code Section 45L tax credit providing multifamilyapartment builders with a tax credit of 2000 per energy efficient unit. These types of projects are eligible for the 45L tax credit.

The 45L credit which previously was set to expire on December 31 2020 allows the eligible contractor of a qualified new energy-efficient dwelling unit a 2000 tax credit in.

179d Tax Deductions 45l Tax Credits Source Advisors

2021 Available Tax Incentives For Energy Efficiency Cova Green Homes

Section 45l Tax Incentive For The Real Estate Industry Extended Through December 2020 Tax Point Advisors

45l Tax Credit Energy Efficient Tax Credit 45l

Section 45l Tax Credit Case Study Apollo Energies Inc

Tax Credit Extended For Home Builders Multifamily Developers Bkd Llp